Analyst ratings are designed to give additional information to investors beyond just what the company is saying, but are analyst ratings reliable? In this article, we'll discuss how to read analyst ratings, what goes into their decision-making process and how potential conflicts of interest influence analyst stock ratings.

What Are Analyst Ratings?

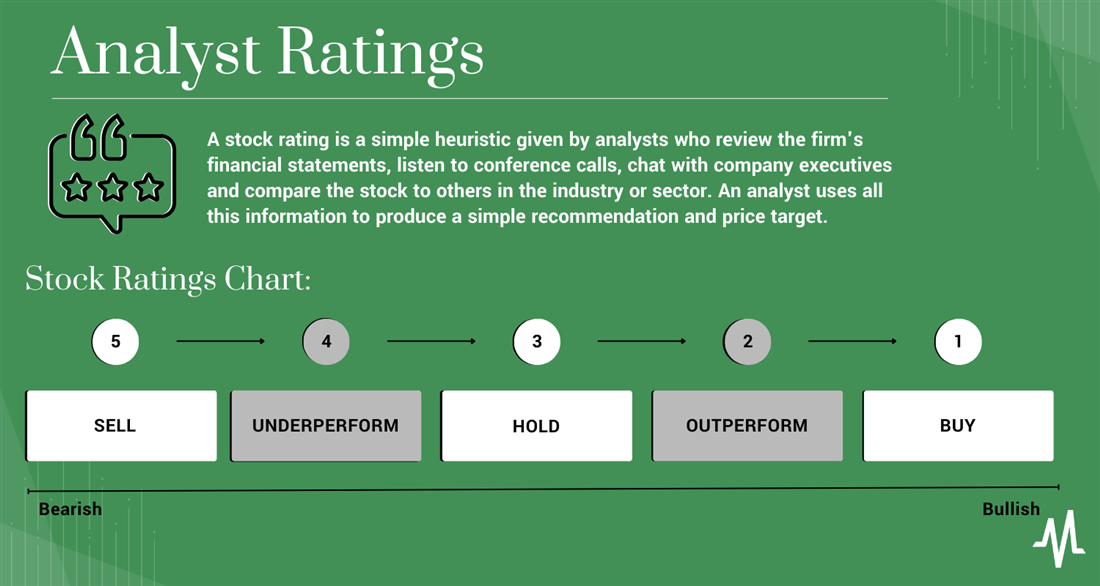

A stock rating is a simple heuristic given by analysts who review the firm's financial statements, listen to conference calls, chat with company executives and compare the stock to others in the industry or sector. Finally, an analyst uses all this information to produce a simple recommendation and price target.

When a public analyst goes on CNBC or the "Wall Street Journal" to give a "buy" or "sell" rating on a particular stock, they take all their research and pare it down into a simple designation. While there's no true consensus on what constitutes a buy or sell rating, an analyst usually does have "skin in the game" when devising ratings.

Ratings often pair with price targets, which put a hard number on what the analysts believe the company stock should be worth. So, for example, you might see an analyst report something like, "Buy NVIDIA Inc. (NASDAQ: NVDA), price target $350," which means that particular analyst believes investors should buy NVDA shares up to a price of $350 per share.

What Does a Stock Analyst Do?

A stock analyst is a market professional with the skills to interpret financial data and the connections within companies to speak on the record with higher-ups. Analysts generally fall into one of two different camps: buy-side or sell-side. These positions will seem similar, but they tend to be employed by various institutions and have different responsibilities in their particular market "territories."

- Buy-side analysts: Analysts on the buy side tend to work for funds, such as ETF providers or hedge funds. They don't dig as deeply into company financial data or conference calls as sell-siders. Instead, they focus on general areas or industries where their funds have vested interests. In addition, buy-side analysts often forge relationships with sell-side analysts for individual stock research. A buy-side analyst's primary goal is to find and utilize the most accurate and dependable sell-side analysts.

- Sell-side analysts: If buy-side analysts work for funds (i.e., institutions that buy securities), you can probably guess which type of institution employs sell-side analysts. Brokers, banks and other firms that sell securities to investors use sell-side analysts to give reports to the public. While buy-side analysts also give ratings and price targets, the reported "buy" and "sell" ratings in financial media typically come from folks on the sell side.

Buy and sell-side analysts often use different rating systems when making their recommendations. You might even find two sell-side analysts with similar "buy" recommendations with vastly different price targets in the same stock. As a result, you'll need to familiarize yourself with the various methodologies analysts use to utilize their research correctly.

What Ratings Do Analysts Give?

Stock analyst ratings don't follow a strict structure, although most have roughly the same grading system for the securities they review. The labels may differ slightly (i.e., overweight vs. outperform), but the five most common analyst ratings go like this.

Buy

Analysts bullish on a particular security will give it a "buy" rating and set a price target above the current market price. In addition, if the analyst considers the stock one of the best in the industry or sector, you'll sometimes see a "strong buy" rating attached.

Hold

A "hold" rating is typically the lowest rating a sell-side analyst gives a stock. "Hold" means the analyst projects the stock to meet the return of the market averages, making it an unspectacular investment. Stocks rated "hold" may still have a price target above the current price, but it's not likely to surpass the return of a major index like the S&P 500.

Sell

Analysts are usually apprehensive about giving a stock a "sell" rating. For example, suppose a "hold" rating indicates indecision over the stock's future. In this scenario, a "sell" rating is issued when an analyst finds something unappealing, such as questionable accounting tactics or cratering sales growth.

Analysts won't always give a firm "buy" or "sell" rating on stock but will instead label it "underperform" or "outperform." "Underperform" means the analyst expects the stock not to keep up with the market. It doesn't necessarily mean the analyst predicts a crash but indicates a lack of confidence in the shares.

"Outperform" is the opposite of "underperform," meaning the analyst expects the stock to do better than the market average. It's usually considered a less confident rating than "buy."

Example of an Analyst Rating

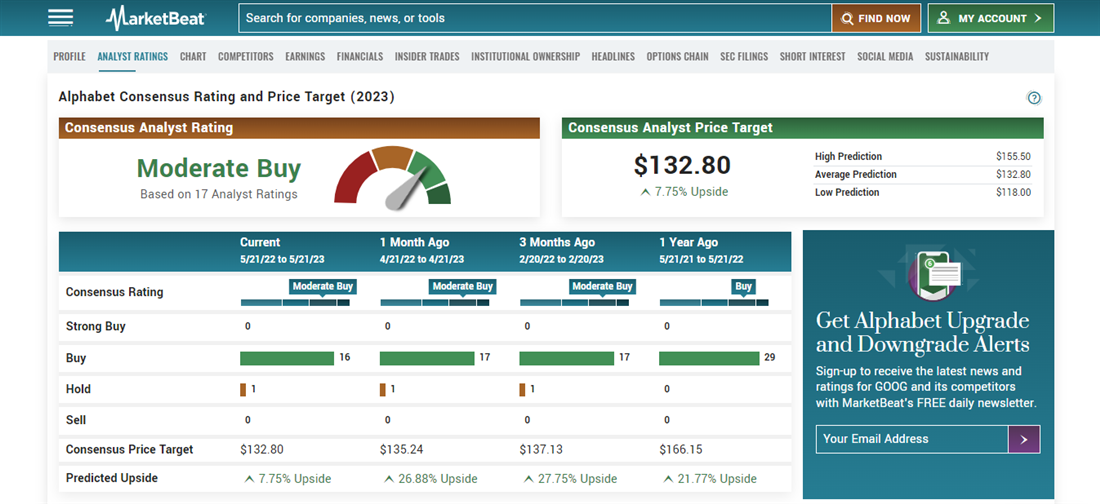

You can use MarketBeat Analyst Ratings to find ranges and aggregates from buy- and sell-side analysts across the financial media. For example, here's a stock that analysts usually love: Alphabet Inc. (NASDAQ: GOOG).

Using MarketBeat's tools, you can find ratings from prominent analysts from multiple periods. Alphabet is currently labeled a "moderate buy" based on MarketBeat's consensus from 17 analysts. You'll get the consensus price target and the highest and lowest from the analysts surveyed.

Using MarketBeat's tools, you can find ratings from prominent analysts from multiple periods. Alphabet is currently labeled a "moderate buy" based on MarketBeat's consensus from 17 analysts. You'll get the consensus price target and the highest and lowest from the analysts surveyed.

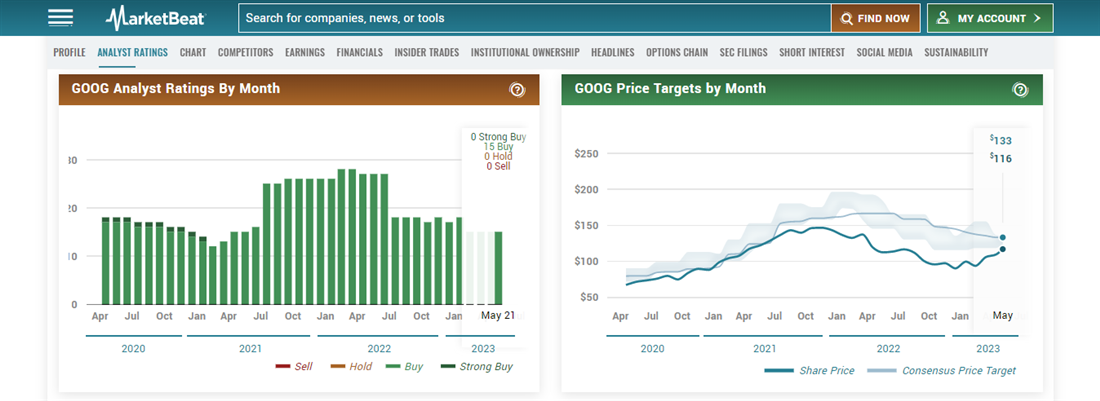

Looking at analyst recommendations over time is another helpful tool. For example, you can view the different levels of coverage over the last few years, which analysts changed their ratings and how the price targets vary from month to month. If an analyst can't get a good read on a particular stock they've been covering, they might choose to withhold their grade, which is one reason why the number of available ratings can change over time.

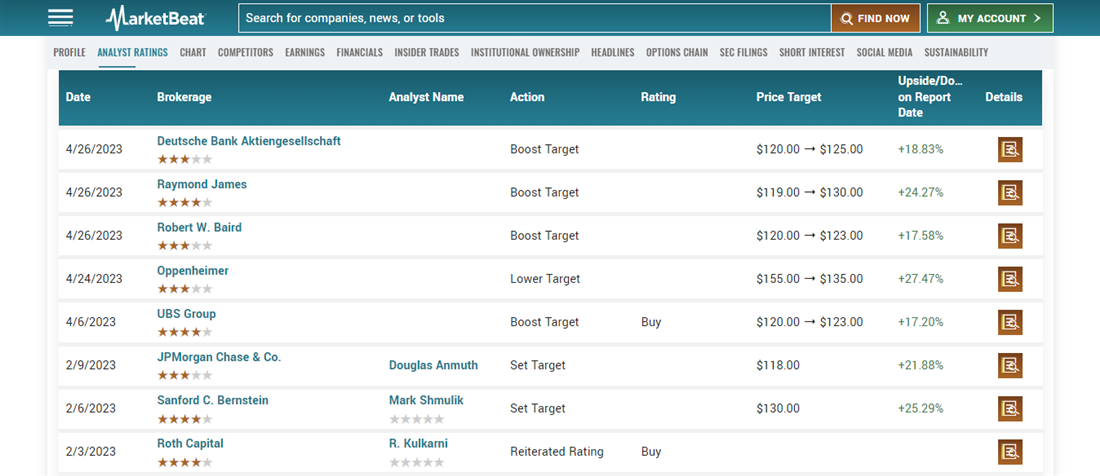

Analysts from both sides of the aisle can be found on MarketBeat, ranging from large firms like JPMorgan Chase and Co. (NYSE: JPM) to smaller investment banks like Roth Capital. Some institutions like UBS Group offer both buy-side and sell-side ratings and analysis. These graphs show that even analysts with similar ratings can have vastly different price targets, so always understand the reasoning behind an analyst's view.

Analysts from both sides of the aisle can be found on MarketBeat, ranging from large firms like JPMorgan Chase and Co. (NYSE: JPM) to smaller investment banks like Roth Capital. Some institutions like UBS Group offer both buy-side and sell-side ratings and analysis. These graphs show that even analysts with similar ratings can have vastly different price targets, so always understand the reasoning behind an analyst's view.

How to Use Analyst Ratings

Here are a few pointers on incorporating analyst ratings into your investment research.

Step 1: Don't rely on a single analyst.

Using an array of analysts (buy- and sell-side) gives inventors the most possible information. Don't just look for analysts with similar opinions as yourself — ensure you understand the pros and cons of each investment you make by incorporating positive and negative views, if possible.

Step 2: Compare analyst ratings across the industry or sector.

It's easy to slap a "buy" rating on a stock and predict a winner, but comparing stocks against others in the sector can offer insight into the rating. For example, if a stock is rated "buy" in the information technology sector, but a dozen others are rated "strong buy" by the same analyst, where is your capital best served?

Step 3: Consider your own goals and risk tolerance.

You might find stocks rated "strong buy" in your research in sectors you wish to avoid. That's fine! There are thousands of securities across dozens of industries in the public markets, and you don't need to purchase every share that comes with a "buy" rating. Instead, stick to your investment plan.

Step 4: Don't stubbornly stick to your original assessments.

Following your investment plan and using analyst ratings as guidelines are practical steps, but things can change over time. Today's "strong buy" stocks could be "strong sell" stocks down the road. Using an aggregate of analysts' ratings can help investors view stocks from a higher level. For example, if the number of "buy" ratings on a stock drops 40% over a few years, you might want to take a closer look at that particular company.

Why Are Analyst Ratings Important?

Checking out analyst ratings isn't a necessary step for investing, but it can be helpful for those looking to dig deep into an asset's prospects. Analyst research often has quotes from company executives, questions from conference calls and in-depth reporting on the company's balance sheet, income statement and other essential documents. Analysis like this is complex for individual investors to do on their own, especially considering how frequently analysts interact with the executives they cover. But access often comes with a downside, which we discuss more below.

How Accurate Are Analyst Ratings?

Both buy and sell-side analysts strive for accuracy because giving consistently wrong commendations can be hazardous for job security. However, investors should be aware that analysts might not always have the best interest of the retail investor at heart when making their recommendations.

For starters, being an analyst requires access to company employees and management. Analysts typically ask questions during conference calls and speak with C-suite executives on the record about their firms' prospects. Executives usually don't want to hear adverse reports about their companies, so analysts are incentivized to paint a rosy picture to retain access. The SEC has been questioning the authenticity of analyst ratings (especially on the sell-side) since 2002 when it asked bluntly, "Why are there so few sell ratings?"

Of course, there are other areas of the securities analysis market to face scrutiny. If you recall, during the 2008 financial crisis, the biggest credit rating agencies were all held to the fire due to claims that conflicts of interest influenced their ratings. The biggest rating agencies in the world were accused of "misrepresenting the risks associated with mortgage-backed securities." Remember, analyst ratings aren't spat out by computer algorithms but by living, breathing people who may have agendas other than providing the most precise and accurate reports on a company's future prospects.

Analyst Ratings Can Guide Investors, but Don't Treat Them as Gospel

Consider each type of investment research or advice in collaboration. Even the most accurate and thoughtful analysts get things wrong, plus ratings are frequently besieged with conflicts of interest. But analyst coverage does offer research that's difficult to get elsewhere, and using an array of analyst reports can give investors a deeper understanding of the securities they buy.

FAQs

Still have questions about analyst ratings? Here are a few answers to some common points of discussion:

What are analyst ratings?

Analyst ratings are the "buy" and "sell" labels, plus price targets, that investment researchers attach to specific securities. These ratings are based on financial data, earnings reports and conversations with company executives.

Should you trust analyst ratings?

Analyst ratings provide plenty of helpful information, but you shouldn't use an analyst's "buy" rating as the sole reason you purchase a security. Analysts aren't immune to conflicts of interest or outside parties' influence, so ensure you always understand why a stock was labeled a "buy" or "sell."

What does an analyst rating tell you about a stock?

Ratings give investors the analyst's overall opinion about a particular stock and price targets based on the company's valuation and prospects. Analysts often attend conference calls, ask questions and provide in-depth information about companies that are difficult to acquire elsewhere.