But before you jump in, it's a good idea to research how to invest in penny stocks.

Investors and traders often perceive penny stocks as having little risk because the financial outlay is low relative to other stocks. But there's often more to penny stocks than meets the eye.

In this article, we'll discuss whether penny stocks are a good fit for you, some examples of penny stocks, and how you can spot the best penny stocks to buy now.

What is a Penny Stock?

So, what is a penny stock? The definition has changed over the years. Originally a penny stock was a stock trading for less than $1. Some investors still believe that a stock is only a penny stock if it trades for $1 or less, but you have more choices today regarding securities considered penny stocks.

The Securities and Exchange Commission (SEC) defines a penny stock as one that trades for less than $5 per share.

While you can find many penny stock listings on major U.S. exchanges such as the NYSE or Nasdaq, other penny stocks don't qualify for those exchanges and are listed over the counter (OTC). You can find those OTC penny stock listings at OTC Markets or on the Pink Open Market, dubbed the Pink Sheets. That nickname originated because quotes for penny stocks were once printed on pink paper.

Pink sheet companies are typically more speculative due to low liquidity and reduced regulatory oversight. Stocks listed on the OTC Markets aren't necessarily penny stocks; many large companies, such as Swiss pharmaceutical firm Roche Holding AG (OTCMKTS: RHHBY) are listed over the counter. But you'll also find many low-priced stocks among the OTC listings and invest penny stock options.

Why Do Investors Buy Penny Stocks?

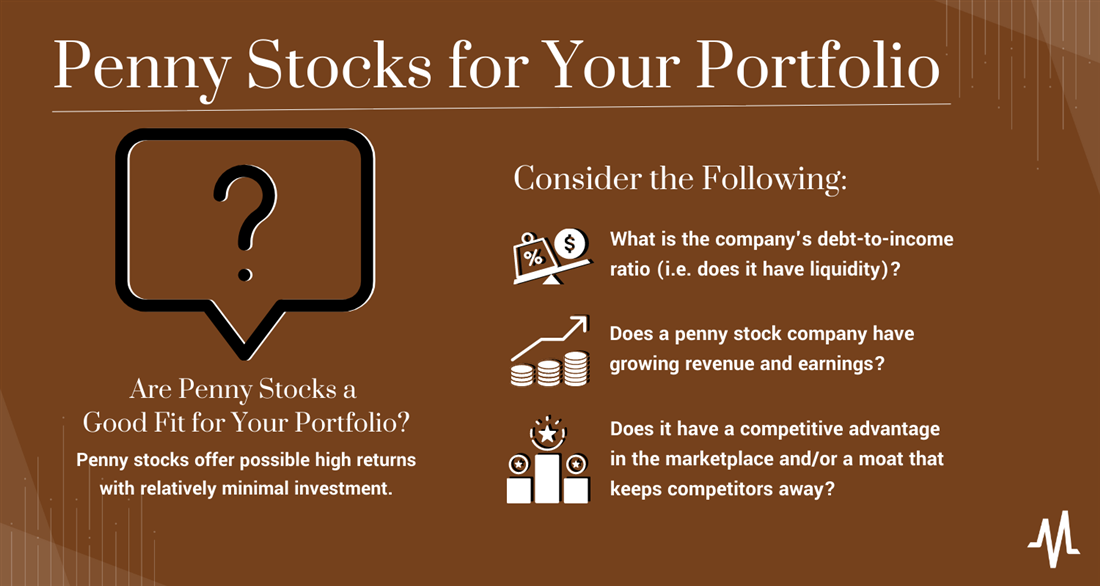

Are penny stocks worth it? However you define penny stocks, it's not tough to see why they are attractive. Penny stocks offer the potential for a high return with a relatively minimal investment. For example, say you find a stock priced at 50 cents. If you wanted to make a 50% profit, you'd only need the stock's price to reach 75 cents.

In addition, you may love the idea that penny stocks' low cost of entry allows you to buy a large number of shares, further increasing their potential reward.

Many people who dabble in penny stocks are speculators, even gamblers. They are attracted to the potential reward of these stocks, driven by technical signals more than fundamental analysis.

Reason 1: Can Buy Many Shares at a Low Price

When you have little money to invest, penny stock prices can be attractive. Not only is it easy to get into the investing or trading game, but you can also buy many shares for a low price.

For example, if you have $2,500 on a stock purchase, you can buy one share of Autozone Inc. (NYSE: AZO) or 25,000 shares of Powerbridge Technologies Co. Ltd. (NASDAQ: PBTS). Sure, Autozone is the higher quality stock and poses less risk, but it just feels more fun to own 25,000 shares than one share; not that "fun" should be the objective of investing, but that's the reality.

Reason 2: Easy to See Gains

If you buy a penny stock and plan to hold it until it doubles in price, you can see a big percentage gain without a huge price gain. For example, if you buy a stock trading at 10 cents a share, it only has to rise to 20 cents to pocket a 100% profit.

But be careful with this reasoning: Even though it doesn't seem like the price needs to rise much to double your return, it's not always easy for any stock to notch outsized price gains. Ultimately, the percentage gain (or loss) matters, not the price itself.

Reason 3: Possible Price Growth

Many investors and traders approach any investment hoping for a huge price increase, but it's easy to make a mistake when it comes to penny stocks.

Don't make the mistake of believing large caps such as Walmart Inc. (NYSE: WMT) began life as penny stocks. When looking at a stock's history, you may see split-adjusted prices that make it seem like a stock was trading under $1 at one point. In Walmart's case, it made its public debut at $16.50 in 1970.

Is it possible to see considerable gains in a penny stock? Of course. Don't make the mistake of believing that some of today's biggest companies once traded for pennies.

Reason 4: Little Competition for Shares

Penny stocks frequently have a low float of shares available to the public, and especially with little-known companies, few traders are bidding for those shares. Getting a stock at the price you want is relatively easy.

You won't compete against big institutions like mutual funds or hedge funds. Their traders and algorithms aren't tracking what penny stocks do, which works in your favor when trying to grab shares.

Reason 5: Can Begin Trading with a Small Account

You don't need thousands of dollars in your account to learn how to trade penny stocks and even begin seeing gains.

This means buying enough shares to potentially turn a profit quickly without waiting months or years to amass enough to invest in more expensive stocks is possible.

What Are the Risks of Investing in Penny Stocks?

All stocks have risks, but penny stock companies have more inherent risk factors. Otherwise, they would draw the attention of institutional investors.

But why are they so risky?

First, penny stocks are usually highly leveraged and in some cases, may even be in bankruptcy.

In addition, they generally have a very small market capitalization, meaning their outstanding shares' value is low. These companies can offer the potential for sensational growth and increase investor risk. A small market cap means a lack of liquidity. Penny stocks are often more difficult to sell quickly, as fewer interested investors are on the other side of the trade.

Institutional-quality stocks generally have some positive aspects when it comes to their fundamentals. Many have growing revenue and earnings, or at least the potential for growth in the foreseeable future.

They also have viable products and services in the marketplace, ready to launch.

Penny stocks, in contrast, often fall short on those points. It's not unusual to see unprofitable penny-stock companies, and many have little or no revenue. They may not yet have a product or service available for purchase or haven't yet gotten any customers.

Good examples of this are biotech companies. These companies may be working on potential breakthrough drugs and therapeutics. However, these companies are subject to strict regulations and must go through a series of clinical trials before turning a profit or even beginning to deliver revenue.

For instance, penny stock Curative Biotechnology (OTCMKTS: CUBT) had no revenue or earnings several quarters after going public. The company was established to develop treatments for rare diseases but had yet to bring any products to market.

The stock's market capitalization was only $100,000, and it had just 2.3 million shares in float. Both those factors add risk for an investor.

While many penny-stock companies are legitimate business endeavors, there's also the risk of fraud in penny-stock investing.

Sometimes investors learn about a company from a newsletter that promises meteoric gains. These newsletters can appear very credible. However, if you read the disclaimers, you'll find that in many cases, the company paid the newsletter editor for an endorsement. This should be a gigantic red flag for you because if a company was a legitimately good investment, it wouldn't need to pay to get an endorsement.

Here are some of the risks you may encounter with penny stocks.

Pump-and-Dump Schemes

The combination of low market cap, low float, sparse regulatory oversight and the possibility of an outsized return can all add up to a greater potential for fraud.

One common fraud scheme is called pump-and-dump. If you want to see this scheme in action, watch the movies "Boiler Room" and "Wolf of Wall Street."

Pump-and-dump occurs when a promoter pressures investors, usually gullible people or those with little knowledge about the stock market, to put money into highly speculative stocks that the promoter already owns, having bought for a much lower price. After unsuspecting investors have piled in, the promoter sells shares at a profit, leaving other buyers in the lurch as the price drops.

It's common to see these schemes promoted in penny-stock newsletters and online platforms. If you are looking for good penny stocks, always use caution and read the fine print when you discover a recommendation.

It's often difficult to find reliable information about penny stocks.

There are a couple of reasons for that.

First, many companies trading over the counter are not subject to the same stringent disclosure rules as companies trading on major exchanges. This can make finding information beyond what you might find in a promoter's newsletter or website challenging.

Even if a company is a legitimate enterprise and trades on a major U.S. exchange but happens to be low-priced, there's often little coverage from either Wall Street analysts or the financial and business media. If you can't find much information about stocks, they may not be appropriate penny stocks to buy now.

High Volatility

Penny stocks are the poster children of volatility. In general, a lower market capitalization translates to higher volatility. That's even true of small caps listed on major exchanges and whose market capitalizations hover at around the $2 billion mark.

But it's a whole different ball game for penny stocks, which can notch big price moves in either direction during a single trading day. The percentage move can be deceptive because the stocks' prices are so low.

For example, U.K.-based cannabis company Akanda Corp. (NASDAQ: AKAN) posted a decline of 27%. It closed at $0.14, down from the previous session's close of 19 cents. Don't be fooled by the prices; that's a huge percentage decline in one session.

These volatile moves can make these stocks notoriously difficult to trade, even with stop losses in place. High volatility can also be emotionally and mentally challenging to a trader.

Low Liquidity

If you're accustomed to buying and selling stocks listed on major exchanges, you may not appreciate the importance of liquidity. When you're getting in or out of a stock, you want to get the exactly price you want, especially if you're a trader. That level of price precision, within pennies, is far less important to an investor with a longer time horizon.

But for traders, low liquidity makes closing a trade at a particular price tougher. Low liquidity results in fewer buyers and sellers, meaning a trader who wants to sell shares at 10 cents apiece may not find buyers at that price and may be forced to accept nine cents. In the world of penny stocks, that could be a significant difference.

In addition, low liquidity is a factor that can make penny stocks ripe for manipulation. That can occur when a stock's price is artificially inflated, with fraudsters selling to pocket gains, while their unsuspecting customers suffer losses. It's difficult to manipulate stocks on the major exchanges with greater liquidity and regulatory oversight.

How to Avoid Penny Stock Risk

While penny stocks are inherently risky, reducing some of that risk is possible.

For starters, have a set amount you are willing and able to lose. Yes, that sounds like a plan for the casino floor at Ceasar's, but you should treat penny stock trading the same way. Only bet a lot of money on penny stocks, hoping to retire on your riches, pay off debt or reach some other goal. Treat penny stock trading as entertainment and budget accordingly.

Focusing on quality and seeking only the best penny stocks is also crucial.

Only trade penny stocks listed on major exchanges, such as the Nasdaq and NYSE. There, you'll find many low-priced stocks, frequently trading below $5, that actually have revenue and earnings and are subject to SEC regulation. Sometimes these stocks of solid companies were beaten down by a company-specific event or a broad market downturn. Focusing on these higher-quality stocks can reduce the risk of pump-and-dump schemes and minimize volatility.

Only trade penny stocks that are available with a major brokerage, such as Schwab or Fidelity. Be sure the broker you use is licensed by regulatory authorities, including FINRA, and is registered with the SEC. That information will be on the broker's Web site, or you can call and ask for documentation. By using these reputable brokers, you also avoid outsized commissions and fees.

How Can Investors Find Penny Stocks?

Penny stocks are listed in a few places, including the OTC Markets or on the Pink Open Market, better known as the Pink Sheets.

However, you can also find penny stocks trading on the NYSE and Nasdaq exchanges.

If you want to learn how to find penny stocks, you're better off putting together a list of companies trading on those major exchanges, reducing your risk of fraud and manipulation.

The companies listed on the pink sheets do not have to file with the SEC and do not need to meet minimum filing requirements, such as submitting a recent financial report.

The penny stocks on the OTC Markets are still not listed on any of the major exchanges, but they must meet some minimum requirements. All of this means that you, as an investor, will lack information, meaning the OTC Markets and the Pink Sheets are not the best places to find penny stocks to watch.

What is the Best Way to Make Money in Penny Stocks?

Expect a learning curve if you want to know how to make money in penny stocks.

Like investing in any asset class, investors can take simple steps to minimize risk.

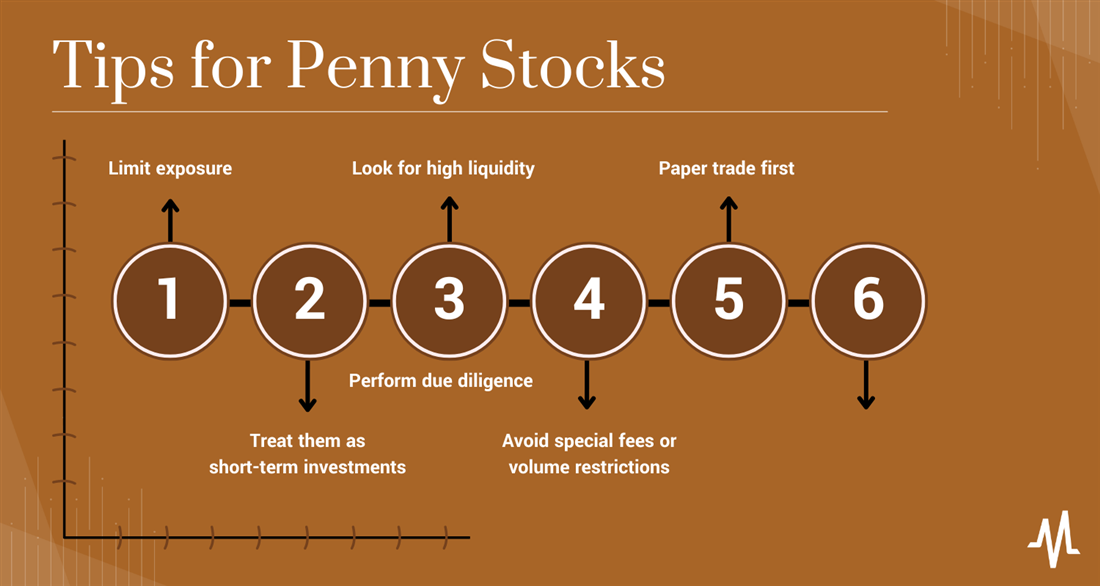

- Limit exposure: Most experts say exposure to penny stocks should be no more than 5% to 10% of their portfolio. In addition, it's a good idea to limit exposure to any individual penny stock to 1% to 2% of your portfolio. This reinforces a fundamental point that investors shouldn't invest any more money in an asset class than they are comfortable losing.

- Short-term investments: Think of a penny stock as a short-term investment. If you profit off of penny stock, you should sell and invest that money into your long-term investments, which will help you avoid losses and keep your exposure to penny stocks at a comfortable level.

- High liquidity: Look for penny stocks with high liquidity, which can help ensure that investors can easily trade these stocks. One way to do this is to look at the average daily trading volume. Since it's possible to own many shares, it's important to pick stocks that allow you to sell a large number of these shares if necessary. In some cases, if the volume of a stock is only 1,500 shares a day and an investor owns over 15,000 shares, there aren't enough buyers to get out of a position quickly.

- Avoid special fees or volume restrictions: Since you likely want to trade these stocks rather quickly, use a trading platform that avoids special fees or volume restrictions. You need to be able to trade these stocks just like any other common stock.

- Paper trade first: This old-school tip can help you decide whether or not a stock is worth your risk, particularly for beginners. Paper trading is a simple concept where you invest an imaginary amount of money and then track your trades without exposing actual money. This helps you see how quickly a stock moves and how much volume changes hands. Many investment platforms make it easy to track your watch list.

- Due diligence: It may be tempting to invest in the latest "hot stock or industry." The penny stock industry is littered with companies advertising the potential to make money in oil, gas, gold and other precious metals. However, if information about a company is not readily available or if a company seems reluctant to provide that information, look for another investment.

- Focus on companies with some interest and/or expertise: If you are a programmer, you may be likelier to separate tech guru hype from real innovation.

- Monitor your trades carefully: Penny stocks aren't in the "set and forget" investment category. If you buy an index fund in your long-term account, you generally don't have to watch the prices like a hawk; in fact, you should just invest and live your life. But penny stocks require setting a price target and then paying close attention to intraday trading. Volatility can mean a sharp downturn resulting in a big loss if you're not careful.

- Be sure you're investing in solvent companies: This will require research beyond what you see on a stock chart or perhaps even what you read in a newsletter. A company in bankruptcy, even if it's larger than most penny-stock companies, presents a tremendous amount of additional risk. It's never worth the trouble, even if you think it would be a fun meme-stock trade. Treat yourself to a movie or a trip to a theme park if you have the itch to spend some money on entertainment.

- Use a good stock screening service: This can help you find potential penny stock companies. This should not be the extent of your research, but it could help you create a quick short list of top penny stocks in an industry. From there, you can do more research. Considering hundreds of penny stock companies exist, having a tool to help you uncover potential candidates can help focus your efforts.

The Last Word on Penny Stocks

While no investment is without risks, penny stocks are hazardous investments for many reasons, including the potential for fraud, lack of transparency and volatility.

When investing or trading penny stocks, remember that if it seems too good to be true, it usually is.

If you limit your exposure to penny stocks, have the time and ability to quickly move in and out of trades, and implement some safeguards, it is possible to make money with penny stocks. But use greater caution than you would with a larger company, particularly if you buy a penny stock not listed on a major exchange.

FAQs

Penny-stock trading differs from swing or even day trading larger, more liquid stocks.

If you're new to the world of penny stocks, here are some frequently asked questions about penny stock investing.

Can you get rich buying penny stocks?

It's never a good idea to ask yourself if you can get rich by trading or investing in any particular asset class, including penny stocks.

While it's certainly possible to make money with penny stocks, use precautions and err on the side of being conservative. If you put pressure on yourself to get rich by trading penny stocks, you will likely make entirely avoidable mistakes.

Which penny stock is best?

The best penny stocks generally trade on a major exchange, such as the NYSE or Nasdaq. The OTC Markets also have some minimal listing requirements, so aren't necessarily as speculative as those on the Pink Sheets.

Nobody can guarantee a return, but the best penny stocks are typically solvent companies with a viable business that you can easily research and verify.

What are the hottest penny stocks?

If you're deliberately seeking the hottest penny stocks, you may be vulnerable to penny stock websites, paid trading education programs, and newsletters. Avoid fast movers and big price gainers when researching penny stocks to buy. Those will likely reverse course even before you make a trade or shortly after.

Instead, ask yourself which penny stocks can mitigate your risk and if you're ready to follow a set of rules when buying these high-risk securities.