This page lists companies that have unusually low price-to-earnings growth ratios (PEG ratios). The PEG ratio is a valuation metric for determining the relative trade-off between a stock's price, its earnings per share (EPS) and its expected earnings growth. It is calculated by dividing a stock's PE ratio by the earnings growth rate. PEG ratios are particularly useful in comparing the valuation of two stocks that have significantly different earnings growth rates. How to interpret PEG (price-to-earnings growth) ratios.

Key Points

- The price-to-earnings (P/E) ratio is a financial data point that compares a company's revenue to its share price.

- Investing in stocks with a lower P/E ratio may offer enhanced potential for growth in share price.

- Investors looking for low P/E growth stocks should carefully evaluate corporate finances before investing to avoid falling into a value trap.

- 5 stocks we like better than Apple

Value investing is a strategy that involves purchasing shares of stock that are currently undervalued by the market — but what can investors look to to determine if a stock is undervalued?

One factor many investors use when searching for portfolio additions is the price-to-earnings (P/E) ratio, which describes a stock's price relative to the amount of revenue it generates. Stocks with a lower P/E ratio may be set for a rebound, but investors must also be aware of the possibility of value traps.

Identifying low P/E growth stocks is possible with the help of market screeners and tools available through MarketBeat. Read on to learn more about finding and investing in stocks with lower P/E values and what a stock's P/E value tells you about your potential investment.

Introduction to Low PE Growth Stocks

The price-to-earnings (P/E) ratio is a financial data point that compares a company's profits to the price of a share of its stock. The P/E ratio is calculated by dividing the share price by a company's earnings per share. Lower P/E values are usually considered beneficial for investors because they might indicate that a company's shares are undervalued relative to the profit it brings in.

Advantages of Low PE Growth Stocks

Many investors look specifically for low PE high growth stocks when evaluating potential growth-oriented companies to add to their portfolio. These stocks may show a higher-than-average rate of returns for investors, which may help the company provide higher dividends to its investors. If the company elects to reinvest profits into operations, this might provide an added margin of safety if the direction of profits turns.

Lower Valuation

As you examine P/E values and the formula, you'll notice that a lower P/E ratio often correlates with a lower share value compared to other companies in the same sector of similar sizes. A low P/E ratio may suggest that a company's stock is trading at a relatively lower price compared to its earnings, which can be a major green flag for value investors looking to add assets to their portfolio that will increase in price over time.

These lower valuations can potentially be parlayed into a contrarian investment strategy. Contrarian investing involves going against the crowd and buying stocks others may avoid due to temporary issues or negative market sentiment. If the market eventually recognizes the stock's true value, it can lead to significant gains for investors who purchased shares while the P/E value was low.

A quintessential example of a low P/E ratio could be seen in Apple's stock throughout the early 2000s. As the company faced future uncertainty, its share price plummeted at the turn of the new millennium. However, its innovative products like the iPod, iPhone and iPad led to tremendous growth, and its stock price soared. Investors who bought Apple when it had a low P/E ratio experienced substantial gains.

Growth Potential

Stocks with a lower P/E ratio may have more room for profit growth, providing an opportunity for growth investors. Low PE growth stocks may show indicators of market skepticism — but if companies are able to address these concerns, share prices might increase rapidly. These companies may also be in a period of restructuring, leading to significant appreciation in profitability if management is able to successfully negotiate a turnaround.

Margin of Safety

Low PE high growth stocks might show an artificially low value before a company introduces a new product. For example, in the early 2000s, Apple was at a directional crossroads before making the jump to introducing some of its signature and most well-known products. Looking for stocks with a low P/E value can provide a margin of safety for investors before a big product launch. If the launch is successful and the company receives a wave of positive media attention, the result could be compounding returns for investors.

Identifying Low PE Growth Stocks

Knowing how to screen for high growth low PE stocks can be challenging, as what is considered a low P/E value can vary by industry. Use these tips to locate stocks with higher growth potential that also have lower-than-average P/E values compared to other companies in the same sector.

Screening Criteria

The search for growth stocks with low PE values begins by defining a low P/E value within the sector in which you compare companies. This threshold might vary depending on the type of companies that you're investing in. For example, the average P/E ratio within the apparel industry was 9.47 in October of 2023, while the average P/E ratio of the oil and gas distribution industry was more than 146. Research the industry average to determine if a stock you're considering buying has a P/E ratio that's comparatively low when you keep the entire industry in mind.

After using a stock screener like this one available from MarketBeat, narrow down sector stocks by relative P/E ratio before moving on to other data points. Additional screening criteria you might want to use when narrowing down your options might include:

- Industry analysis: Focus on industries or sectors with growth potential if your primary goal is capital appreciation. Look for sectors expected to outperform the broader market due to trends or changing consumer preferences. Consider industries with a history of cyclical downturns, as companies in these sectors may have temporarily low P/E ratios during economic downturns but may rebound when economic conditions improve.

- Financial health: Financial health is an important indicator of business longevity. Look for companies with a track record of increasing earnings year after year, as this might be a positive indicator of a growth stock. You can view data points like debt levels and revenue on the company's balance sheet, which is released regularly according to SEC regulations.

- Dividend history: Some investors look for low P/E stocks because these companies might have the resources to pay regular dividends, offering an immediate return on investment. High-quality dividend-paying stocks with low P/E ratios can provide income and potential for capital appreciation. Still, you'll want to look for companies that offer both quality returns and profits to support payments over time. Dividend yield and payment history are key features to examine when evaluating dividend strength.

Additional screening criteria you might want to consider could include management quality, valuation compared to growth over time and changes in debt level over time.

Finding the best growth stocks with low PE values starts with the right set of screening and evaluation tools. You might want to use the following resources when narrowing down your stock and ETF selections.

- Stock screener: Stock screeners are online tools that allow you to select stock criteria and only view assets that display all of the characteristics you're looking for. These tools may allow you to input a desired P/E ratio and other criteria, such as market capitalization and sector to narrow down the list of potential low P/E stocks. MarketBeat's stock screener goes a step further, allowing you to filter using characteristics like analyst sentiment.

- Financial news website: Besides stock screeners, it can be helpful to keep a finger on the pulse of market news to identify low P/E stocks sooner. MarketBeat offers a dynamic market news feed and access to market and financial calculators that can help refine your trading strategy.

- Brokerage account: As a retail investor, you'll also need access to a brokerage account before you can buy and sell shares of any stock. Familiarize yourself with your broker's account options, tools and commission and maintenance fees before trading to minimize time and financial waste.

Risks and Challenges

Low P/E values are not a guaranteed sign that an investment will rise in value — in some instances, a stock's lower value accurately reflects its inability to sustain operations. The following are some risks and challenges associated with investing in stocks with comparatively lower P/E values.

Market Volatility

Low P/E growth stocks are not immune to the sudden changes in value that come with periods of high market volatility. Low P/E stocks may be particularly sensitive to sentiment shifts, as they may have been overlooked or undervalued during normal market movements. Positive sentiment can lead to rapid price increases, while negative sentiment can result in steep declines. These movements can shake your confidence as an investor, potentially jeopardizing your returns or trading strategy.

Some low P/E stocks may have lower trading volumes, making buying or selling large positions more challenging without impacting the stock's price. Examining daily average trading volume before investing can help you predict what type of spreads you'll have to overcome when you decide to sell the asset. Taking a long-term perspective to investing can also help mitigate the effects of market volatility on your portfolio value, as share values tend to reach fair market valuation over time.

Identifying Value Traps

Value traps are risky situations that low P/E growth investors need to keep an eye out for. A value trap occurs when a stock appears to be undervalued based on metrics like the P/E ratio, but it turns out to be a poor investment because the company's fundamentals deteriorate or its growth prospects do not materialize as expected. In these cases, the low P/E value does not indicate that a stock is undervalued but accurately reflects poorer prospects for the future.

Avoiding value traps starts with research. Conduct extensive research on the company's financial health, competitive position and industry dynamics before entering a position. Don't rely solely on P/E ratios when evaluating stocks to add to your portfolio — consider other fundamental metrics and qualitative factors, including debt levels and analyst ratings. If a stock has consistently underperformed its industry or the broader market over an extended period, it could be a warning sign of deeper issues.

Strategies for Investing in Low PE Growth Stocks

Investing in low P/E growth stocks usually involves taking a long-term approach to corporate valuation. The best strategy to invest in these types of assets is usually the buy-and-hold approach. This long-term strategy consists of purchasing and holding shares of stocks without actively selling and repurchasing the asset. For example, investors who purchased shares of Apple stock in the early 2000s and held the asset until the 2010s saw a compound in share price, which translates to profits when the investor sells the assets.

Diversification is also a crucial component of investing in low P/E growth stocks. Sometimes, a low P/E value does not reflect improper market valuation but accurately reflects legitimate investor concerns about corporate longevity. Investing in multiple companies across various sectors mitigates your risk and may help limit losses on a long-term timeline.

Case Studies and Examples

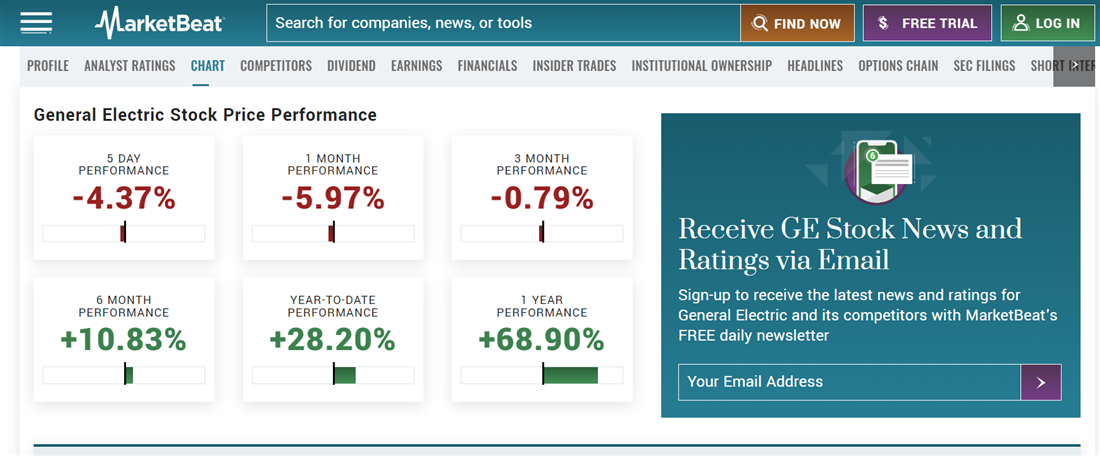

Apple is far from the only stock to show periods of value for investors associated with market uncertainty and a low P/E ratio. General Electric (NYSE: GE) is another example of a company that persevered during periods of low P/E values to provide long-term investors with enhanced returns.

General Electric was historically known as one of the world's largest and most diversified conglomerates, operating in industries ranging from healthcare to aviation. GE Capital, the financial services arm of General Electric, had become a significant part of the company's operations by the early 2000s. While this allowed GE to capitalize on sales in the insurance and lending sphere, it also exposed the company to challenges faced in the financial services sector after the burst of the dot-com bubble.

During this period, GE managed to maintain a diverse portfolio of assets across multiple non-financial sectors. Its long history and brand recognition allowed it to survive the financial crisis of 2008 — and while its stock price has never recovered fully to its pre-2000s levels, its low P/E ratio during this period caught the attention of many investors. Investors who purchased during this period saw up to 100% returns, with the potential for continued future valuation increases.

Identifying Undervalued Assets

While investing in low P/E stocks usually involves a long-term trading strategy, it's still important to reevaluate your holdings over time. Low P/E values can sometimes indicate a low-value stock and may continue to deteriorate over time. Setting a stop-loss order or maximum target loss percentage can help you avoid value traps and focus on companies showing the best growth in your portfolio.