Travel and hotel stocks can be fun to explore, especially if you're interested in the travel industry. Read on to learn how to invest in hotel stocks, a few of the best hotel stock options trading now and more about how to enter the market.

Overview of the Hotel Industry

The hotel industry is a major contributor to the global economy, employing millions worldwide and generating billions of dollars in revenue annually. It's also highly competitive, with hotels constantly seeking ways to differentiate themselves and provide better service to guests. This competition has resulted in a healthy global hospitality market with multiple top hotel stocks entering indexes like the S&P 500.

There are many hotel stocks, each of which caters to a different population segment. Full-service hotels, the most common type of hotel stock, provide a limited range of amenities and services ideal for both business and leisure travelers. In addition to full-service hotels, budget and luxury hotels refine their services to meet the specific needs of their clientele. Hotel companies are a major segment of the travel and hospitality industry, with major chains like Hilton operating in over 100 countries.

Why Invest in Hotel Stocks?

The travel and tourism industry is a rapidly growing sector of the global economy, and hotels are an essential component of this industry. As the global economy continues to recover from the effects of the COVID-19 pandemic, the demand for hotel accommodations is likely to increase. This potential for growth and capital appreciation for hotel stock investors can make the industry appealing to short-term and long-term investors.

Many hotel companies have a global presence, operating hotels in multiple countries and regions worldwide. Investors can gain exposure to a wide range of markets and help to diversify their portfolio beyond the domestic tourism industry. The hotel industry is also known for strategic acquisitions and partnership opportunities, which can provide unique growth opportunities.

3 Ways to Invest in the Hotel Industry

There are multiple types of hotel stocks to buy, and the difference between hotel chains is due primarily to differences in target market. Before exploring other travel stocks on MarketBeat, learn more about the major types of hotels and the stocks that make up each sector or industry.

Full-Service Hotels

Full-service hotels are large, upscale properties that offer guests a wide range of amenities and services. These hotels typically target business travelers, convention-goers, and leisure travelers looking for a high-end experience. They often feature on-site restaurants, bars, fitness centers, meeting and event spaces, and a range of services such as concierge and room service.

Marriott International Inc. (NASDAQ: MAR) is a quintessential example of a full-service hotel chain, offering travelers stays at more than 7,600 properties across 130 countries and territories. While each Marriott's offerings vary by location, guests will find a full fitness center and restaurant in most major locations. In April 2023, Marriott International had a total market capitalization of $51 billion.

Limited-Service Hotels

Limited-service hotels are a type of hotel that offers a more basic and streamlined guest experience compared to full-service hotels. These hotels typically provide a more affordable option for travelers looking for comfortable and convenient accommodations without all the bells and whistles of a full-service hotel.

These budget accommodations offer a smaller range of amenities and services compared to full-service hotels. They may not have on-site restaurants or bars and often do not offer room service. However, many limited-service hotels provide complimentary breakfast, high-speed internet access and limited fitness facilities.

These accommodations offer a more budget-friendly option than full-service hotels, making them attractive for travelers looking to save money. They're also a popular choice for companies and organizations looking to manage employee travel expenses. Summit Hotel Properties (NYSE: INN), the company that operates the Holiday Inn Express chain of properties, is an example of a limited-service hotel provider.

Luxury Hotels

Luxury hotel accommodations are at the opposite end of the spectrum from limited-service hotels. Luxury hotels provide guests with the highest-quality amenities and services in prime locations such as city centers, beachfront or mountain resorts. These hotels offer guests an exclusive and luxurious experience that goes above and beyond the typical hotel stay.

Luxury hotels usually have a high staff-to-guest ratio, which allows them to provide a level of service tailored to each guest's individual needs and preferences. This includes customized experiences such as private tours, customized dining options, and personalized spa treatments. Examples of luxury hotel stocks include Mandarin Oriental International Ld. (LON: MDOB) and Hilton Worldwide Holdings Inc. (NYSE: HLT), which operates the luxury Waldorf Astoria and Conrad series of hotels in addition to full-service and limited-service options.

How to Invest in Hotel Stocks

Now that you understand the basics of the hotel industry, you can begin exploring hotel investments. Learn how to buy hotel stocks and add these resilient travel assets to your portfolio.

Step 1: Open a brokerage account.

Begin your investing journey by selecting a broker offering a platform that fits your needs. Some features you should consider when comparing brokers include fees, the markets and assets you can trade and the types of accounts the broker supports.

Brokers like TD Ameritrade appeal to experienced investors looking for a range of active trading tools.

Brokers like TD Ameritrade appeal to experienced investors looking for a range of active trading tools.

Step 2: Explore the industry.

After opening your brokerage account, familiarize yourself with both major names in the hospitality industry and the multiple types of stock available for purchase. Most brokers allow you to create a watchlist of stocks, making it convenient to see how a few key performers change in price over time. Select a few hotel stocks to monitor before making your first purchase.

Step 3: Fund your account and place an order.

After comparing stocks on MarketBeat or your research platform of choice, choose a few key hotel stocks you'd like to add to your portfolio. To diversify your risk and minimize the chances of sharp losses, you may want to invest in hotel stocks from multiple sectors or use a hospitality ETF as your primary investment vehicle.

After linking a bank account or credit card to make your investment, fund your account. Most brokers allow you to fund your account using a wire transfer, which carries the least fees and may allow you to access trading funds immediately. Place a buy order for the asset you want to add to your portfolio. .

Step 4: Monitor the news and your stocks’ performance.

If your broker completes your order following current market conditions, you'll see the stock in your portfolio. Monitor its value over time and keep up to date with distributions that your stocks pay out. You can use a tool like this MarketBeat dividend calculator to predict your upcoming dividends to manage your reinvestment schedule.

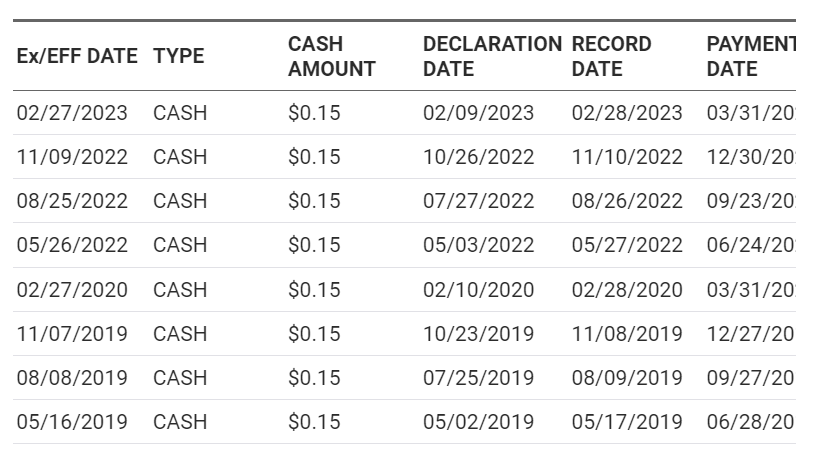

Some hotel stocks (like Hilton) pay out consistent quarterly dividends.

Some hotel stocks (like Hilton) pay out consistent quarterly dividends.

Pros and Cons of Investing in Hotel Stocks

While investing in hotel stocks can provide diverse exposure to the tourism industry, these assets are often more volatile than consumer staples sectors. Consider both the pros and cons before deciding to invest.

Pros

The benefits of investing in hotel stocks includes the following:

- Potential for growth post-pandemic: While travel and hotel stocks took a hit during the pandemic, many major chains have rebounded as global travel resumes. This can provide investors with unique opportunities to purchase undervalued assets.

- Dividend payments: Hotels can provide a reliable income stream for investors, as they typically generate revenue through room bookings, food and beverage sales and other amenities. Many major hotel stocks offer dividend payments to investors, creating the potential for passive income.

- Exposure to international markets: Many major hotel companies operate properties worldwide, providing investors with exposure to international markets and potential growth opportunities in emerging tourist destinations.

Cons

On the other side of the coin, the cons include:

- Economic sensitivity: The hotel industry is highly sensitive to economic conditions, as travel and tourism tend to decrease during economic downturns. This can result in lower occupancy rates and hotel revenue, leading to seasonal losses for investors.

- Operational risks: The hospitality industry is subject to various operational risks, including competition, natural disasters, regulatory changes and reputational risks. These issues arose during the COVID-19 pandemic when travel stocks saw sharp, sudden losses. Future events of a similar nature could sway performance.

Future of Hotel Stock Investing

The future of hotel trends will likely be marked with a few key changes in consumer preferences. Investors increasingly seek opportunities to invest in companies committed to sustainability and social responsibility. This trend will likely impact the hotel industry as travelers become more conscious of their environmental and social impact. Expect to see more major hotel chains take steps to reduce guests' environmental footprints.

The COVID-19 pandemic has significantly impacted travel behavior, with many travelers shifting towards domestic and regional travel and emphasizing safety and hygiene in their decision-making. Hotel companies that can adapt to these changing trends may succeed in the market.

Which Hotels Will Thrive Post-Pandemic?

Are hotel stocks a good buy? Overall, the future of hotel stock investing will likely be shaped by various factors, including sustainability and social responsibility, technological advancements, shifts in travel behavior and expansion in emerging markets. If you do decide to invest in individual hospitality stocks, be sure that these consumer discretionary investments make up a manageable percentage of your overall portfolio to limit concentrated losses.

FAQs

Look at the most common frequently asked questions about hotel stocks.

What is the best hotel stock to buy now?

The best hotel stock will vary depending on your investment timeline and goals. For example, some investors may prefer investing in large, established hotel companies with a strong track record of performance and a diversified portfolio of properties. Others may prefer to look for opportunities in emerging markets, which may result in higher capital appreciation.

Are hotels a good stock investment?

Hotels can be a good long-term investment because they usually produce steady dividends and provide a consistently in-demand service. However, demand for hotel stays may be cyclical, making these investments more volatile in the long term. Like any individual industry, hotel stocks should never make up the majority of any investor's portfolio.

What is the most undervalued hotel stock?

To tell what the most undervalued hotel stock is at any moment in time, look at the stock's price-to-earnings ratio (P/E ratio). A lower P/E ratio may indicate that a hotel stock is undervalued when its current price compares to its latest earnings report.