As exciting as all this is, it's no surprise you're wondering how to invest in energy. When this article is through, you'll have a better idea of the types of energy investments, where to find them and which may be best for your needs.

Overview of the Energy Industry

The most direct investment method in the energy industry is buying energy sector stocks or mutual funds from companies across the energy spectrum, from big oil companies to alternative energy startups.

Investing in commodities such as crude oil, natural gas and coal offers another option. These are traded on commodities markets like the New York Mercantile Exchange (NYMEX). Commodities trading can be riskier than investing in stocks since prices can be affected by things like geopolitical events and weather patterns.

Finally, derivatives trading is another option. Derivatives are contracts that derive value from an underlying asset, such as a stock, commodity or currency. They can be traded on regulated exchanges and over-the-counter (OTC) markets. This type of trading is complex and carries more risk than the best energy stocks to buy now, as the prices can be much impacted by changing market conditions.

Types of Energy Companies

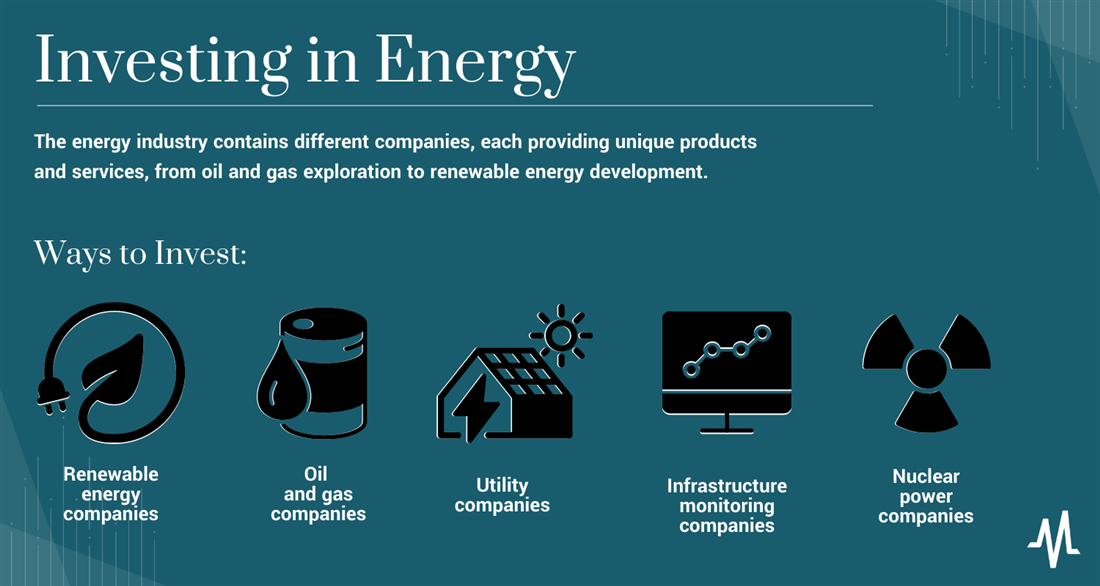

The energy industry contains different companies, each providing unique products and services, from oil and gas exploration to renewable energy development.

Renewable Energy Companies

The renewable energy industry is booming. These companies generate power through solar, wind, geothermal and hydroelectricity. Solar energy is one of the most popular renewable energy investments. Companies like SunPower Corp. (NASDAQ: SPWR) and First Solar Inc. (NASDAQ: FSLR) produce photovoltaic (PV) panels that convert sunlight into electricity. Wind energy has also grown in popularity over the last few years, with companies such as Vestas Wind Systems A/S (OTCMKTS: VWSYF). Siemens Gamesa Renewable Energy SA (OTCMKTS: GCTAF) and Xinjiang Goldwind Science & Technology Co. Ltd. (OTCMKTS: XJNGF) making gains in this sector.

Geothermal energy produces power by tapping into natural heat from underground, while hydroelectricity involves using water to turn turbines to generate electricity. Many renewable energy companies are publicly traded. Figuring out how to invest in renewable energy stocks can be a great way to get involved in the green movement while diversifying your portfolio.

Oil and Gas Companies

Oil and gas companies are also publicly traded. These companies explore, extract, refine and market petroleum products like gasoline, heating oil and diesel fuel. The types of oil and gas stocks are often categorized by the roles they play in the industry.

At the top of the chain are major oil and gas companies such as Exxon Mobil Corp. (NYSE: XOM), Chevron Corp. (NYSE: CVX), BP PLC (NYSE: BP) and Shell PLC (NYSE: SHEL). These giant corporations are involved in all aspects of the industry, from exploration to production to refining and distribution.

Exploration and production (E&P) companies focus specifically on finding new sources of oil and gas, then extracting them from the ground or seafloor. They often lease land for drilling rights.

Oilfield services firms provide support and technical services to E&P companies like drilling, well completion and maintenance. Some examples include Halliburton Co. (NYSE: HAL), Schlumberger Limited (NYSE: SLB) and Baker Hughes Co. (NASDAQ: BKR).

Midstream companies focus on the transportation and storage of oil and gas. They build and operate pipelines, storage tanks and other infrastructure to move oil and gas from the wellhead to refineries. Midstream companies are generally less volatile than E&P firms since their revenues tie to the volume of oil and gas produced rather than the price.

Finally, downstream companies refine and sell petroleum products to end-users such as gas stations, airlines and manufacturing. As a consumer, you might be most familiar with companies such as Phillips 66 (NYSE: PSX) and Valero Energy Partners (NYSE: VLP). Changes in demand and prices at the pump can impact them.

Utility Companies

Utilities generate and distribute electricity and natural gas to homes and businesses. These companies often operate in regulated markets, which can provide a stable source of revenue. Examples include Duke Energy Corp. (NYSE: DUK), The Southern Co. (NYSE: SO) and American Electric Power Company Inc. (NASDAQ: AEPPZ). Utility stocks can be a way to diversify your portfolio, as they can have lower volatility than other energy stocks.

Infrastructure Monitoring Companies

Infrastructure monitoring companies ensure that energy networks and systems remain operational and secure. They monitor the system in real-time, detecting any irregularities that may indicate a malfunction or security breach. Companies such as Siemens Energy AG (OTCMKTS: SMEGF) and EnerNOC Inc. (NASDAQ: ENOC) specialize in monitoring services for renewable energy. These companies often have stable revenues as they provide critical services.

Nuclear Power Companies

The nuclear power industry relies on uranium-based fuel to generate electricity relatively cheaply and with environmental impact. But investing can be risky since the sector requires government approval and public trust, though it has the potential for high returns. Some well-known nuclear power companies include Exelon Corp. (NASDAQ: EXC), NextEra Energy Partners LP (NYSE: NEP) and Duke Energy. Approach this industry with caution and thoroughly research the companies you're considering.

How to Invest in Oil and Gas

Oil and gas investments can greatly diversify your portfolio and take advantage of potential growth. First, you can look for the best oil stocks and invest directly in them. But these can be volatile. When prices go up, so do stock prices. Even the top 50 oil and gas stocks suffer in value when prices drop. Be aware of current market conditions, and diversify so that gains on another can offset any losses on one stock.

Investing in E&P companies can be rewarding if you're willing to take risks. These firms experience wild price swings due to their exposure to volatile global commodity markets. If you have a lower risk tolerance, look into oilfield services firms and midstream or downstream oil companies' stock. Investments in utility and infrastructure monitoring companies can also help diversify your energy holdings. Nuclear power stocks also offer an opportunity if you're more risk-tolerant.

Another option is to invest in energy exchange-traded funds (ETFs). Energy ETFs track an index such as the S&P Global Energy Index or Dow Jones U.S. Energy Sector Index, which measures performance across all major energy sectors. Many ETFs also provide dividend payments.

If you read the news every day, you know oil and gas are subject to fluctuations in the global market. Ensure you're financially prepared for any swings.

How to Invest in Uranium

Since the dawn of the nuclear age, uranium has been a critical component used to power nuclear reactors, providing approximately 11% of the world's electricity in 2022. The price has shown steady growth over the past few years. But investing directly in uranium stocks or funds can be challenging due to their limited availability and thin trading volume.

One way is to purchase stocks in companies that produce uranium. They typically operate mines where they extract uranium ore and refine it. Some well-known stocks in this sector include Cameco Corp. (TSE: CCO) and Rio Tinto Group (NYSE: RIO).

You can also invest in ETFs tied to uranium prices. Two popular ETFs are the Global X Uranium ETF (NYSEARCA: URA) and the VanEck Vectors Nuclear Energy ETF (NYSEARCA: NLR). These funds track the Solactive Global Uranium Index.

Another way to invest is through purchasing physical uranium, either as ore or in refined form, and storing it yourself or through a custodian. This can be risky, as there are few buyers for uranium, and its price can be volatile. Storing uranium safely can also be complicated and expensive because it's highly radioactive.

How to Invest in Pipelines and Oil Refining

Pipelines provide infrastructure for transporting oil and gas, and refining converts crude oil into gasoline and diesel. Pipeline investments typically come in two forms: master limited partnerships (MLPs) or ETFs. MLPs offer a share of profits generated by the pipeline network and often have attractive dividends. Of course, always consider the companies' safety records, environmental practices and regulatory environment.

How to Invest in Renewable Energy

Investing in renewable energy is an environmentally friendly alternative to fossil fuels and an effective way to reduce your carbon footprint. You can invest directly in stocks of companies involved with the industry. ETFs such as iShares Global Clean Energy ETF (NYSEARCA: ICLN) and Invesco Solar ETF (NYSEARCA: TAN) can also offer you exposure.

Pros and Cons of Investing in Energy

Investing in energy can significantly diversify your portfolio and capitalize on the growing demand for energy worldwide. However, there are some potential risks.

Pros

Check out the potential benefits of investing in energy:

- Diversification: Energy investments can hedge against market volatility, reducing overall portfolio risk.

- High returns: The best energy stocks have historically produced higher returns than the broader stock market.

- Predictable cash flows: Oil and gas companies often have long-term contracts with customers that provide stability and predictable cash flows.

- Tax benefits: Oil and gas companies may be eligible for various tax benefits, including depletion allowances, research and development expense deductions and intangible drilling costs.

Cons

The downsides of investing in energy, on the other hand, can include the following:

- Volatile prices: The price of oil and natural gas is subject to supply and demand pressures, causing large swings, sometimes resulting in significant losses in the short term.

- Political risks: Changes in government policies, regulations or taxes can impact profits.

- Environmental concerns: Oil and gas companies carry environmental risks due to fracking or offshore drilling. Rigorous safety standards can help protect against these risks.

Future of Energy

The future for energy stocks and other investments is constantly changing due to new technologies. Wind, solar and hydropower are catching on as clean and reliable sources of power, and advances in battery technology have made it more feasible to store energy for later use. Advances in carbon capture technology can help reduce emissions from fossil fuels and make them more efficient.

Keep the Lights on in Your Portfolio

Investing in energy can be lucrative. It can help diversify your portfolio and give you a stake in the growing global demand for energy. If you're looking for energy stocks to buy, remember that stocks, ETFs and renewable energy projects can offer possible high returns, predictable cash flows and tax benefits. However, they also carry volatile prices and political risks. As the world works to reduce carbon emissions, investment in renewable energy sources will remain attractive as long-term investments.

FAQs

Below are some of the most frequently asked questions you might still have about investing in energy:

Are energy stocks a good investment?

A good energy stock can offer potentially high returns, predictable cash flows and certain tax benefits. However, they also come with volatility due to price changes and political risks. Always carefully research the company's fundamentals and diversify by sector, geography and fuel type.

What is the best way to invest in energy?

The best way to invest in energy depends on your individual investment goals. Direct investments such as stocks, ETFs and mutual funds offer more control and potential for higher returns, while renewable energy projects provide the chance to support environmentally friendly technologies.

Are energy stocks good in a recession?

Top energy stocks can be a good investment in a recession as they tend to be insulated from market downturns and often are countercyclical, which means they can often rise even in a downturn. However, practice due diligence and be mindful of their potential volatility.