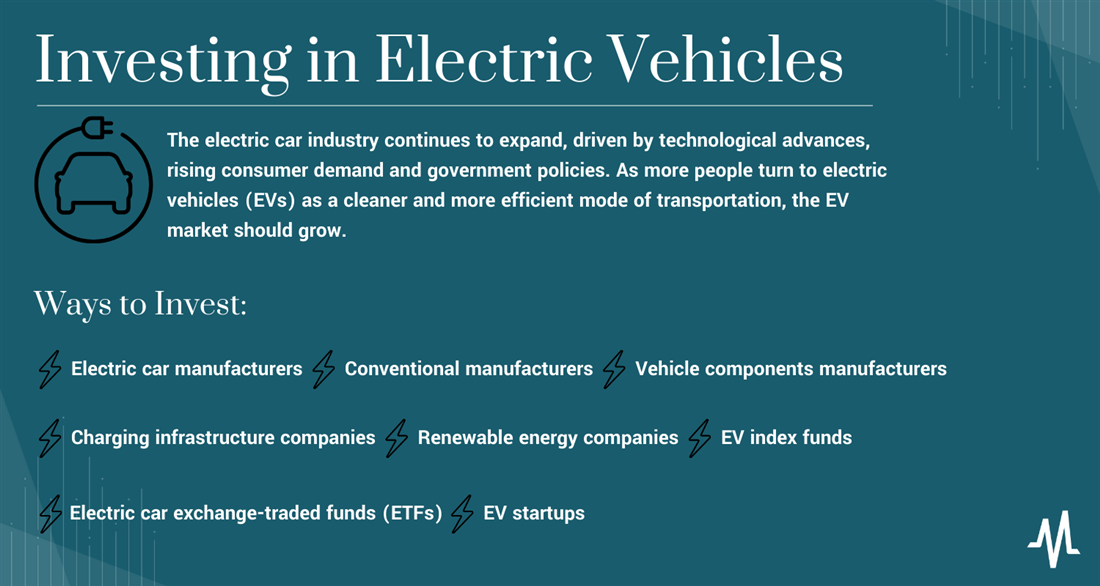

Investors looking to capitalize on the electric car industry's growth potential have several options for how to invest in the EV market. They can invest in electric car manufacturers, traditional car manufacturers with electric vehicle initiatives, electric vehicle component manufacturers, charging infrastructure companies and renewable energy companies.

Let's explore these different investment options, discuss the factors investors should consider and look at key information for how to invest in EV stocks.

Ways to Invest in Electric Cars

Electric car investing and the broader electric vehicle (EV) industry has become increasingly popular in recent years, but what is the best way to invest in EV market growth? Investing in the electric car industry can be done in various ways.

Electric Car Manufacturers

Several companies exclusively focus on developing and producing electric vehicles (EVs), including Tesla, NIO, Rivian, Lucid Motors and Fisker. By investing in these companies, investors can gain exposure to the growth potential of the electric car market.

Conventional Manufacturers

Many conventional car manufacturers, such as Ford, General Motors, Volkswagen and BMW, also invest heavily in EV development. By investing in these companies, investors can gain exposure to both the traditional auto industry and the growth of the EV market.

Vehicle Components Manufacturers

Electric vehicles require specialized components such as batteries, motors, and power electronics. Companies such as Panasonic, LG Chem and QuantumScape are involved in producing EV components. By investing in these companies and other top-rated tech stocks, investors can benefit from the growth of the electric car industry through the companies that supply its components.

Charging Infrastructure Companies

As electric vehicle adoption grows, the charging infrastructure demand will also increase. ChargePoint, Blink Charging and EVBox are all involved in producing and installing electric vehicle charging stations. Investing in these companies can provide exposure to the growth potential of the electric vehicle charging infrastructure market.

Renewable Energy Companies

The growth of the electric vehicle market closely ties to the adoption of renewable energy sources. Companies such as NextEra Energy and Enphase Energy are involved in producing and distributing renewable energy sources such as solar and wind. By investing in these companies, investors can benefit from the growth of renewable energy, a vital enabler of the electric vehicle market.

EV Index Funds

An EV index fund is a type of mutual fund that tracks a predetermined list of companies related to the electric vehicle industry. The index fund typically includes companies involved in producing and manufacturing electric vehicles, EV components and charging infrastructure and companies supporting EV development, such as renewable energy firms. By investing in an EV index fund, investors can gain exposure to a diversified portfolio of companies poised to benefit from the growth of the EV industry. The performance of an EV index fund will typically track the performance of the underlying index, which can be either market-cap weighted or equally weighted.

Electric Car Exchange-Traded Funds (ETFs)

Investors can gain exposure to the electric car industry through Exchange Traded Funds (ETFs) focusing on electric cars or related industries. Exchange-traded funds (ETFs) are similar to an EV index mutual fund, with one main difference. The index fund seeks to match the performance of the underlying market, while the EV ETF is traded on an open exchange like a stock and can be bought and sold throughout the day. Examples of such ETFs include the Global X Autonomous & Electric Vehicles ETF (NYSEARCA: DRIV) and the iShares Self Driving EV and Tech Fund (NYSEARCA: IDRV).

EV Startups

Another option is to invest directly in startups and private companies in the electric car industry. However, this method carries higher risks and requires extensive research to assess the company's potential. Investing in startups helps drive the adoption of electric vehicles, widely seen as a megatrend.

Overview of the EV Industry

The electric vehicle (EV) industry is a rapidly growing automotive industry sector that dedicates itself to the design, development, and production of electric-powered vehicles. Electric vehicles use batteries and electric motors instead of traditional combustion engines to propel the vehicle. The industry has seen significant growth in recent years, driven by increased awareness of the environmental impact of conventional combustion engines, advancements in battery technology, and government incentives to reduce carbon emissions.

The EV industry is divided into several subsectors: passenger cars, commercial vehicles, buses, two-wheelers and recreational vehicles. In the vehicle segment, companies such as Tesla, NIO, Rivian and Lucid Motors focus exclusively on developing and producing electric vehicles. Meanwhile, traditional automakers such as Ford, General Motors, Volkswagen and BMW invest heavily in EV development.

The companies involved in producing and distributing EV components, such as batteries, electric motors and power electronics also support the growth of the EV industry. This also includes the raw materials to make these components, like lithium which is vital to the EV battery industry. Investing in lithium and lithium stocks is another route to investing in the broader EV industry.

In addition to EV manufacturers and component suppliers, the industry includes companies that provide charging infrastructure, such as ChargePoint and EVBox. As EV adoption grows, the demand for charging infrastructure will also increase. Investors interested in supporting the infrastructure that makes charging EVs possible should review MarketBeat's best EV charging stock list to learn more about how to invest in electric car charging stations.

The EV industry is closely linked to the growth of renewable energy, such as solar and wind power, as they provide the energy needed to power EVs. NextEra Energy and Enphase Energy produce and distribute renewable energy sources. Investors could invest in renewable energy indirectly in the broader electric vehicle market.

How to Invest in Electric Cars

As the electric vehicle (EV) industry continues to gain momentum, investors are increasingly interested in ways to participate in the growth of the sector. Some investors wonder how to invest in electric vehicle stocks, while others are interested in how to invest in electric car charging station stocks.

The investment method may vary depending on whether you are interested in investing in individual EV stocks, a mutual fund that tracks the electric vehicle market, or an ETF that comprises a diverse group of companies with exposure to the EV market.

If you're interested in investing in the electric vehicle market but are unsure about which investment option is best suited for you, there are a few steps you can take to make informed decisions as you learn how to invest in electric vehicles stocks.

Step 1: Do your research.

Before investing in any investment, it's essential to do your research. Look into the investment options available, potential risks and rewards, and past performance. A great place to start your research is to learn ways to invest in EV stocks.

Step 2: Assess your risk tolerance.

Determine your risk tolerance or the level of risk you are comfortable taking with your investments. This will help you determine which investment option is best suited for you. A financial advisor can also help you determine which investment option best suits your goals and risk tolerance.

Step 3: Buy into the EV market.

Once you've decided which investment option to pursue, you'll need a brokerage account with a reputable firm. You will want to do your research and choose the brokerage firm that works best for you, depending on if you are interested in individual EV stocks, an EV mutual fund or an ETF.

Step 4: Monitor your investments.

Monitoring your investment in the electric vehicle market is a critical step in the investment process to ensure your portfolio remains on track to meet your goals. To achieve this, you should track your investment performance regularly to see how it's performing relative to your goals and risk tolerance. Review your investment allocation to align with your goals and risk tolerance. If your objectives have changed, you may need to adjust your investment allocation accordingly.

Step 5: If needed, rebalance your portfolio.

Rebalancing is necessary because it can help you manage risk and maximize returns. Rebalancing refers to adjusting your portfolio's holdings to maintain your desired asset allocation. This means selling assets that have become overweight in your portfolio and using the proceeds to purchase assets that have become underweight. Rebalancing helps you maintain a consistent level of risk in your portfolio and ensures that your investment strategy remains aligned with your goals.

As the electric vehicle market evolves, certain stocks may outperform while others underperform, which can cause your portfolio to become unbalanced. You must rebalance your portfolio to avoid overexposing yourself to a particular stock, fund, or sector, which can lead to significant losses if the market experiences a downturn.

On the other hand, rebalancing your portfolio can help you take advantage of market trends and ensure that you're well-positioned to benefit from the growth potential of the electric vehicle industry. This is a critical part of investment management, particularly in a volatile market like the electric vehicle industry. The EV market is known for experiencing rapid growth and dramatic fluctuations, making it essential for investors to rebalance their portfolios regularly.

Keep updated on industry news and trends to ensure your investment decisions remain informed and relevant. Additionally, keeping an eye on industry trends and staying knowledgeable about the electric vehicle market news is essential. Technology, regulations or consumer preferences changes can significantly impact the industry and your investments. You can be better prepared to make informed investment decisions by staying up-to-date with these trends. By monitoring your investment portfolio and adjusting as needed, you can increase your chances of achieving long-term success in the electric vehicle market.

Investing in the electric vehicle market can be a rewarding experience, but it's important to remember that all investments carry some risk. By researching, consulting with a financial advisor and monitoring your assets, you can make informed decisions and help ensure that your investments are on track to meet your goals.

Pros and Cons of Investing in Electric Cars

As with any investment, there are both pros and cons to investing in the electric vehicle industry. On the one hand, electric vehicles are a rapidly growing market with tremendous potential for future growth, driven by increasing consumer demand for sustainable transportation and government initiatives to reduce carbon emissions. On the other hand, the electric vehicle industry is still in its early stages. As with any emerging market, investors should be aware of risks and uncertainties.

Understanding the potential risks and rewards is essential in making an informed investment decision. Let's explore some pros and cons of investing in the electric vehicle market to help you determine whether it's the right choice for your investment portfolio. By weighing the potential advantages and disadvantages of investing in the electric vehicle industry, you can make a more informed decision about allocating your investment capital and building a diversified investment portfolio that aligns with your investment goals and risk tolerance.

Pros

The electric vehicle market presents many opportunities for investors looking for sustainable and environmentally friendly investment options. Investing in the electric vehicle market can support the transition to a cleaner and more sustainable future. Some other pros include:

- Growing market: The electric vehicle market should grow rapidly in the coming years as more governments worldwide set targets for net-zero emissions and incentivize consumers to switch to electric vehicles.

- Environmental benefits: Investing in electric vehicles is a way to contribute to reducing carbon emissions, which is critical in combating climate change. As electric vehicles produce zero emissions, they are a cleaner and greener option for transportation.

- Technological advancements: The electric vehicle market is relatively new, and the industry has much room for innovation and growth. Companies continuously develop and improve electric vehicles' performance, efficiency and battery technology, which presents opportunities for investors.

- Government incentives: Governments worldwide are implementing incentives to encourage the adoption of electric vehicles, including tax credits, subsidies and grants, which can positively impact the electric vehicle market's growth.

- Reduced dependency on fossil fuels: Investing in electric vehicles can help reduce dependence on non-renewable energy sources such as oil and gas, as electric vehicles are powered by electricity and renewable energy sources such as solar and wind power. Investing in renewable energy sources presents opportunities for investors.

- Improved air quality: Electric vehicles produce fewer pollutants than traditional gasoline-powered vehicles, which can help enhance air quality and reduce respiratory illnesses. Investing in the electric vehicle sector could make the world a better place.

- Diversification: Investing in the electric vehicle market is a way to diversify one's investment portfolio and reduce reliance on traditional energy sources and transportation methods.

- Lower operating costs: Electric vehicles have lower operating costs than gasoline-powered vehicles, as electricity is cheaper than gasoline, and electric vehicles require less maintenance. These facts will help consumers transition to electric cars as conventional vehicles age and present opportunities for investors.

- Brand recognition: Investing in electric vehicle companies such as Tesla, NIO and Rivian can expose investors to well-known brands that are pioneers in the electric vehicle market.

Cons

While there are many compelling reasons to invest in the electric vehicle market, it's essential also to consider the potential downsides. Here are some of the cons to keep in mind when investing in the EV market.

- Dependence on government regulations: The success of the EV market is highly dependent on government regulations and incentives, such as tax credits and rebates, which can change over time and vary by region. Any regulation changes can significantly impact the EV market, making it more difficult to predict long-term returns.

- Limited infrastructure: While EV infrastructure is growing, it still needs to be improved compared to traditional gasoline vehicles. The limited number of charging stations may deter consumers from purchasing EVs, and a lack of infrastructure may limit the industry's growth potential.

- Competition and innovation: The EV market is highly competitive, and new entrants are continually emerging. Established automakers and technology companies are investing heavily in EV development, making it difficult for newer companies to gain market share. Additionally, the pace of technological innovation is rapid, making it challenging to predict which companies will be successful in the long term.

- Fluctuating battery costs: The battery is one of the most significant components of an EV, and its price can significantly impact the cost of producing an EV. The cost of batteries has been steadily declining, but it can still be volatile, and any significant increase in battery costs could impact the profitability of EV manufacturers.

- Market volatility: The EV market is still relatively new and is subject to market volatility. The stock prices of EV manufacturers and related companies can be highly volatile, making it difficult to predict returns.

Future of EV Tech

The future of the electric vehicle market should be strong and positive, with continued growth and expansion in the coming years. The market is driven by several factors, including government policies promoting clean energy and reducing carbon emissions, advances in battery technology, and increasing consumer demand for electric vehicles. With many countries announcing bans on the sale of gasoline-powered cars in the coming years, the need for electric vehicles will increase.

Additionally, with electric vehicles becoming more affordable and practical for everyday use, more and more consumers are likely to switch from traditional gasoline-powered cars. As major car manufacturers continue to invest heavily in the development of electric vehicles, the market is expected to become increasingly competitive, driving innovation and further improving technology.

While certain risks and challenges are associated with investing in the electric vehicle market, the overall outlook for the industry is positive, with continued growth and expansion expected in the years to come.

Drive Forward with Electric Car Investments

As the electric vehicle market continues to gain momentum, investors have an opportunity to participate in the growth of this exciting industry. By investing in electric car charging stations, electric vehicle stocks, EV-related electronically traded funds or electric vehicle index funds, investors can participate in the movement toward a cleaner and more sustainable transportation industry.

While risks and challenges are involved in investing in the electric vehicle market, the potential rewards are significant. As more governments worldwide set aggressive targets for reducing greenhouse gas emissions, demand for electric vehicles is expected to continue to rise. In addition, advances in battery technology and charging infrastructure are likely to make electric cars even more appealing to other industries and consumers.

Investing in the electric vehicle market has the potential to generate significant returns and contribute to a more sustainable and cleaner future. By investing in the future of transportation, investors can confidently drive forward, knowing they are playing a role in the transition toward a more sustainable and efficient transportation system.

FAQs

Do you have questions about investing in the electric vehicle market? We've got you covered. This FAQ section will address some of the most commonly asked questions about investing in electric cars. Whether you're a seasoned investor or just starting, these answers will provide valuable insights into electric vehicle investing.

What is the best electric car stock to invest in?

It's difficult to pinpoint a single "best" electric car stock to invest in, as the market is constantly changing, and you must consider many factors. The most popular electric car stocks currently include Tesla, Nio and General Motors. However, doing your own research and making investment decisions based on your individual goals and risk tolerance is essential. Additionally, it's important to remember that past performance does not indicate future results.

Are electric cars worth the investment?

Whether electric cars are worth the investment depends on individual investment goals and risk tolerance. While the electric vehicle industry is snowballing, it is still a relatively new and volatile market. Investing in electric car stocks or funds can yield high returns but also comes with risks.

Can you invest in electric car mutual funds?

Yes, you can invest in electric car mutual funds. These funds typically invest in various companies involved in the electric vehicle industry, such as manufacturers, suppliers, and charging infrastructure providers. Investing in a mutual fund can provide diversification and professional management of your portfolio.